Boost Your Financial Planning with Offshore Trust Services

Wiki Article

Charting New Horizons: Broadening Your Riches Administration Profile With Offshore Depend On Solutions

The Benefits of Offshore Trust Providers in Riches Management

You'll be amazed at the advantages of overseas trust fund services in riches management. Offshore count on services supply a large range of advantages that can significantly boost your riches management profile. One of the crucial advantages is the ability to secure your possessions. By developing an overseas count on, you can safeguard your wealth from possible lenders, legal actions, and other monetary dangers. offshore trust services. This supplies you with a feeling of safety and assurance understanding that your possessions are well-protected.Second of all, offshore depend on services supply enhanced discretion. Unlike conventional onshore trust funds, offshore counts on provide a greater level of personal privacy and privacy. This can be particularly useful for individuals who value their monetary privacy and desire to maintain their assets away from spying eyes.

In addition, overseas trusts give tax obligation advantages. Many offshore territories use desirable tax regimens, allowing individuals to legally reduce their tax liabilities. By utilizing offshore trust fund services, you can reduce your tax obligation obligations and preserve a larger portion of your wide range.

Furthermore, offshore trust funds allow international diversity. By buying foreign markets and holding assets in various territories, you can spread your danger and possibly increase your financial investment returns. This diversity strategy can assist you achieve lasting economic development and stability.

Key Considerations for Including Offshore Trusts Into Your Profile

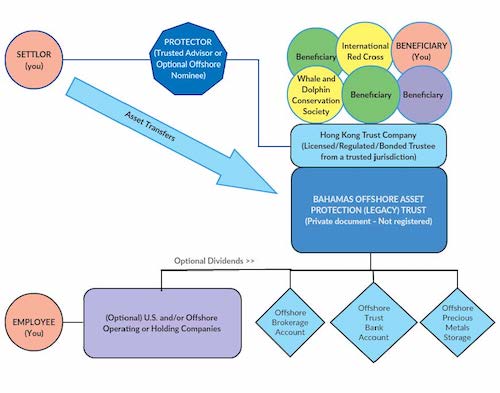

When integrating offshore counts on into your investment method, it is very important to consider crucial variables. Offshore trust funds can supply countless advantages, such as asset protection, tax advantages, and personal privacy. Prior to diving into this type of investment, you need to carefully analyze your objectives and goals.First of all, it's important to select the best jurisdiction for your overseas trust. Various countries have different legislations and guidelines, so you need to find a territory that straightens with your specific requirements. You should consider elements such as political stability, legal framework, and track record.

Second of all, you must extensively research study and select a respectable trustee to handle your offshore trust. The trustee plays a vital role in safeguarding and providing your possessions. Look for a trustee with a strong record, competence in offshore trust fund administration, and strong economic stability.

In addition, you have to know the coverage needs and tax obligation ramifications associated with overseas trusts. It's essential to adhere to all applicable regulations and regulations to stay clear of any lawful concerns or charges in your house country.

Finally, it's necessary to on a regular basis review and check your overseas count on to guarantee it continues to be aligned with your financial investment objectives. Economic and political changes can affect the efficiency of your trust, so staying notified and aggressive is important.

Exploring International Jurisdictions for Offshore Trust Fund Services

Selecting the ideal territory is essential when checking out global alternatives for offshore counts on. With a lot of countries supplying overseas trust services, it is necessary to consider different variables before choosing. You need to assess the jurisdiction's reputation and stability. Try to find countries with solid legal systems, political stability, and a reputable financial sector. This will certainly ensure that your possessions are shielded which the territory will certainly remain to support your trust in the long-term.One more important factor to consider is the tax obligation benefits supplied by the jurisdiction. Various nations have various tax regulations and laws, and some may provide much more positive tax rates or exceptions for offshore depends on. By carefully analyzing the tax ramifications of each territory, you can optimize your wide range and lessen your tax obligation responsibilities.

Ultimately, take into consideration the convenience of doing business in the territory. Seek countries with solid financial facilities, efficient regulative structures, and an encouraging business atmosphere.

Optimizing Tax Efficiency Via Offshore Trust Structures

Taking full advantage of tax performance can be attained via overseas trust structures that supply beneficial tax rates and exemptions. By establishing an overseas count on, you can tactically handle your riches and decrease your tax responsibilities.Among the key advantages of overseas trusts is the capability to defer taxes. By positioning your possessions in a trust fund, you can delay the settlement of tax obligations till a later date or even prevent them altogether sometimes. This can be especially advantageous for people with significant financial investment earnings or those that expect future tax obligation increases.

Furthermore, offshore trust funds use a have a peek at these guys level of personal privacy and possession protection that you might not locate in your house jurisdiction. By placing your assets in an overseas depend on, you can secure them from legal disputes and prospective lenders. This can give satisfaction and protect your wide range for future generations.

It is necessary to keep in mind that while offshore trusts supply tax obligation benefits, it is crucial to adhere to all relevant tax legislations and policies. offshore trust services. Functioning with skilled experts that specialize in overseas count on frameworks can make sure that you make best use of tax obligation efficiency while continuing to be fully certified with the legislation

Mitigating Risk and Enhancing Property Defense With Offshore Trusts

To alleviate risk and enhance asset protection, you can count on offshore counts on, which give a level of privacy and lawful security that might not be available in your home territory. Offshore counts on supply a tactical option for guarding your wealth by positioning your properties in a different legal entity outside of your home nation. By doing so, you can secure your properties from prospective lenders, legal actions, and other dangers.One of the major advantages of using offshore counts on is the level of privacy they afford. Unlike in your house territory, where your monetary information may be conveniently accessed by government authorities or various other interested parties, offshore trusts supply a higher level of confidentiality. Your economic and individual details are have a peek here kept confidential, enabling you to maintain a greater degree of control over your properties.

Moreover, offshore depends on can use improved possession security. In case of litigation or monetary problems, having your properties in an overseas trust can make it harder for financial institutions to reach them. The trust fund works as an obstacle, supplying an included layer of protection and making it harder for anyone looking for to seize your assets.

In addition to personal privacy and property defense, overseas trust funds can additionally provide tax obligation benefits, which better contribute to your total danger mitigation technique. By thoroughly structuring your depend on, you can possibly minimize your tax obligations and enhance your estate planning.

Final Thought

In final thought, by integrating overseas count on solutions right into your wealth management portfolio, you can delight in countless advantages such as tax obligation effectiveness, possession defense, and access to international jurisdictions. Do not miss out on the chances that offshore trust fund services can use to grow and protect your riches.Unlike standard onshore this page trusts, offshore depends on offer a greater level of personal privacy and confidentiality. Offshore counts on can use countless advantages, such as asset protection, tax benefits, and personal privacy. Different nations have different tax regulations and policies, and some may use a lot more positive tax obligation rates or exemptions for overseas trust funds.Optimizing tax obligation performance can be attained with offshore trust structures that offer favorable tax rates and exemptions.In conclusion, by integrating offshore count on services into your riches administration portfolio, you can delight in various benefits such as tax obligation performance, property defense, and accessibility to international jurisdictions.

Report this wiki page